You will find a noticeable pit to have mortgage possibilities anywhere between $301 and you can $dos,five-hundred  within these areas because the California keeps an increase limit regarding 36% towards the loans in this range

within these areas because the California keeps an increase limit regarding 36% towards the loans in this range

This 36% cover appear to is regarded as also lowest by the industry to allow an acceptable profit. Although there several lenders in the Ca who had been lending lower than 36% or simply more than it as authorized by unique guidelines having financing between $500 and you may $10,100000, there’s no limit for the funds ranging from $2,501 and you will $ten,100000. During the Sep regardless of if, the official legislature enacted a rules that have a good 36% Apr cover into funds between $2,501 and $10,000, and is on the governor’s table today getting signing. not, even with which speed cap, the newest rules appear to lets other incorporate-on charge – credit insurance coverage or other kinds of insurance coverage including charges – that can allow it to be quite high prices even after this speed cover.

After loading, money from the California’s advised 36% limitation rate of interest will more like conventional pay check financing, charging consumers nearly 150%. However, as the incorporate-towards products are not commercially financing focus, they’re not used in price calculations, and you may people are not aware of one’s actual will cost you. “Heading payday loans change is actually a license to have predatory lending”, William Rothbard, San francisco Chronicle, .)

And when the bill is actually signed, Ca will have a new price ecosystem for those money if this type of incorporate-ons commonly put or banned; however, if they are perhaps not banned, Ca borrowers nonetheless usually face quite high attract funds as usually anyone else in lots of almost every other says that do not has actually similar limits in place. (“A bigger and you may Prolonged Loans Pitfall”, Federal Consumer Laws Cardio, .)

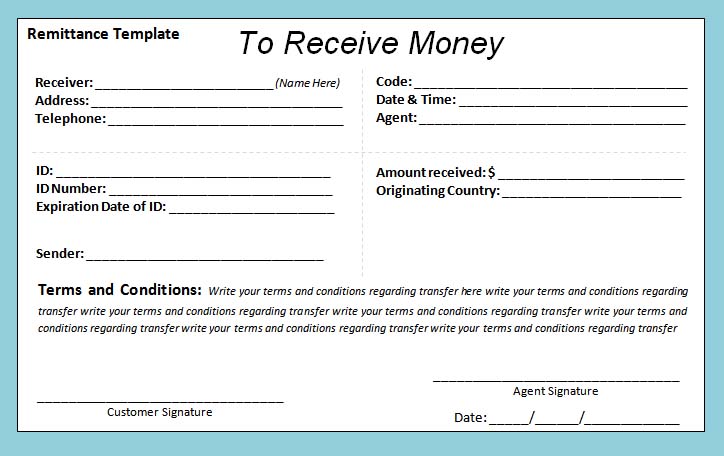

Eg, an evaluation away from a good $5,000 shielded automobile title mortgage for a motor vehicle get so you’re able to CDF fund and you will payday loan can be quite unsettling. The loan conditions revealed from the photos below out-of cues out-of one to shop show dos and you may 3 seasons terms and conditions. At the our very own shop, we quite often discover actually prolonged mortgage terms of 42 weeks one to constantly are used of the loan providers. That have an apr out of 135% and you will a loan identity of 42 months, the loan causes a whole attention fee regarding $18,, or having a-two-seasons term, the entire attention reduced might possibly be $9,. A 1-12 months title would end in $cuatro,352 within the focus.

CDF comes after a different financing method. We produce an incredibly in depth funds into the a get noticed spreadsheet so you can determine the fresh applicant’s earnings; and in addition we legs the loan identity about this cash flow rather than just applying the same name to every candidate. This means that, we have generated only 1 loan over couple of years and you will nearly our very own financing enjoys step 1 to one.5 season terms and conditions otherwise smaller. Below all of our mortgage term and rates (29%), the degree of notice paid back on this subject financing might possibly be $step 1,.

This will produce interest repayments out-of $26, (or $six,068 for the attract for example season) than the a-1-year CDF loan ultimately causing interest money away from $step 1

Compared, a quick payday loan from $300 at California’s market pricing create bring about an interest fee regarding $step one,170 more one year if it was basically folded more than truthfully all two weeks getting twenty-six minutes into the per year. Most individuals do not replace all of the two weeks for one seasons; when they carry out, they generally wind up either paying off or defaulting will eventually while others replenish periodically but shortly after particular age of delinquency. Within our feel, i barely have observed a pay-day debtor make persisted loans having 2 yrs; inside men and women circumstances, the brand new borrowers have a tendency to is delinquent for some amounts of time very they aren’t taking out fully finance most of the two weeks.